By

Bloomberg

Published

November 4, 2024

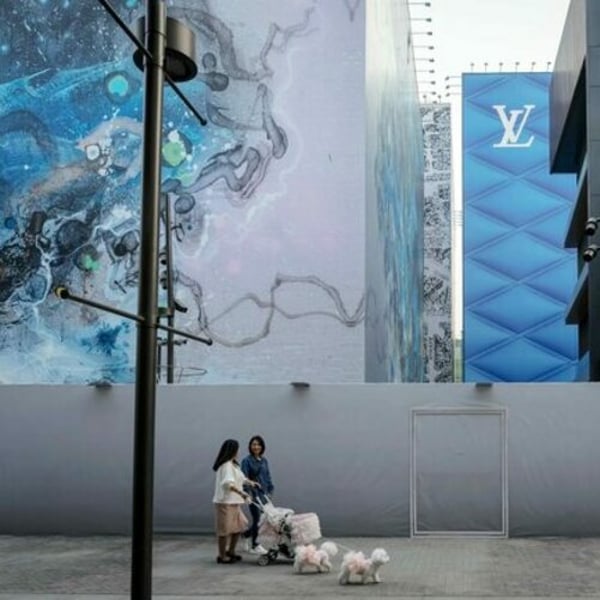

When LVMH CEO Bernard Arnault toured China in June last year, he visited a five-story site in Beijing where the company’s top brand Louis Vuitton planned to open its flagship store in the first half of 2024. More than a year later, the building remains fenced off. The store may not open until as late as next year, according to people familiar with the matter.

The slow progress of such a key project is symbolic of the challenges European luxury firms such as Louis Vuitton Moet Hennessy SE (LVMH) face in China. Demand that was supposed to roar back after the lifting of strict Covid restrictions is instead cratering, a disappointment that’s helped erase about $251 billion from the stock market value of these brands since March.

Signs that the slump has further to run are multiplying. Sales people at Hermès, whose Birkin bags could easily sell for tens of thousands of dollars, reduced how much shoppers need to spend to be able to buy the iconic products in a rare move, according to people familiar with the matter. Companies including Kering SA and Burberry Group Plc are resorting to discounts of as much as 50% to clear stock.

Sales executives, used to being pestered by clients about the latest product range, are struggling to get VIPs to return calls. To entice its biggest spenders in China, LVMH paid to fly a group of them to Paris for the summer Olympics. After years of heady growth, China’s luxury market is expected to shrink as much as 15% this year, according to consultancy Digital Luxury Group.

The downturn is partly cyclical, with China’s economy struggling to recover from a nationwide housing crisis. But even more concerning for Europe’s luxury giants are indications of a permanent shift in demand. President Xi Jinping’s campaigns to crack down on corrupt government officials and promote a more equal distribution of income have made displays of wealth not just passé, but potentially dangerous. Meanwhile, younger Chinese consumers are increasingly spending their money on experiences like travel rather than status symbols.

“Headwinds are the policy-driven ‘luxury shame’ and the economic challenges, leading to slower disposable income growth and the weaker wealth effect,” said Gary Ng, senior economist at Natixis SA. “For many, showing off their wealth may not be wise at this juncture.”

Louis Vuitton’s future flagship store in Beijing is located in a shopping complex operated by Swire Properties Ltd. Two neighboring buildings are leased to LVMH’s Dior and Tiffany, and the timetable for their openings is unclear. No one was available to comment at LVMH, despite repeated requests.

A Swire spokesperson said works on the Louis Vuitton store are proceeding to schedule, and the brand opened a temporary store at a different part of the complex in September while work is underway on the flagship. Swire maintains “full confidence” in the luxury retail market in mainland China, the spokesperson said.

A Hermès spokesperson said the company doesn’t impose a spending threshold to purchase its products.

Companies such as LVMH and Kering poured billions of dollars into China to meet rising demand as the country boomed. Between 2011 and 2021, China’s luxury goods market rose more than four times to CHY471 billion ($66 billion), according to consultancy firm Bain & Co.

Steven An recalls how when he turned up at events in Shanghai as a senior executive for a PR firm last decade, everyone wore luxury.

“In those years, you would find that almost everyone around you was wearing clothes that were at least ‘LV-level,’” said An, who is founder of fashion consultancy Chi Design. “Hermès, Chanel and LV were the most common brands.”

Now demand is falling as early projections that a post-Covid boom in spending would be sustained are proved wrong.

Kering warned that its annual profit will fall to the lowest level since 2016 after comparable sales at Gucci, the French fashion group’s biggest label, tumbled 25% in the third quarter due to China’s slowdown. LVMH reported a 16% slump in the region that includes China in the same quarter, wider than its 14% drop in the previous three months.

“Consumer confidence in mainland China today is back in line with the all-time low reached during Covid,” said LVMH CFO Jean-Jacques Guiony during the company’s earnings call last month.

Swiss watch exports to China tumbled 50% by value in September from a year earlier, putting pressure on companies such as Richemont, the group behind Vacheron Constantin and IWC, and Omega owner Swatch Group AG.

Cosmetic manufacturers too are suffering. L’Oreal SA reported a 6.5% drop in like-for-like sales in North Asia last quarter, with the company saying the beauty market in China continued to deteriorate. Estée Lauder Cos. pulled its guidance for the year in part due to weak demand in China, where sales fell by a double-digit percentage in the three months to September. Its shares plunged by a record.

The tumbling sales reflect a noticeable mood shift in China.

“The modus vivendi nowadays, for social reasons partly, is ‘be discreet,’” Serge Weinberg, founding chairman of Weinberg Capital Partners and a board member of Kering, said in a September interview with French TV network BFM Business. “The big watches, the bags, the visible items, put them aside to preserve social unity. And that’s a change in behavior. How long will it last, I don’t know but we have to take this into account.”

Beijing has stepped up its efforts to tackle corruption, with a record number of senior officials ensnared in the past two years. Previously high-flying industries such as finance and tech have been brought to heel.

Yet only part of the blame can be attributed to Xi’s graft-busting efforts, given such campaigns have been a hallmark of his leadership since he came to power more than a decade ago.

Economic worries have taken center stage as the slump in the housing market deepened, fueling pessimism among consumers. Where once was a gilded age, social media users now refer to the present era as the “garbage time of history.”

Coco Li, 46, used to spend about HK$600,000 ($77,000) a year — or roughly 20% of her income — buying luxury items. After losing her job as an executive at a multinational company in Hong Kong, she’s curtailed her habit and put some of her Hermès handbags up for sale on mainland Chinese online platforms.

“In the past, I just bought luxury without thinking as long as I liked it,” said Li. “I don’t have anything special that I want to buy now because I don’t know where my future income will be.”

Luxury goods in China are being “deprioritized, especially for middle-income earners,” said Jonathan Siboni, CEO of consultancy Luxurynsight, adding that his company’s data shows a quarter of Chinese consumers find Western brands less appealing than 12 months ago.

Over-expansion is part of the problem.

“If you rise too fast, you go down quickly,” said Brunello Cucinelli, founder and executive chairman of luxury cashmere maker Brunello Cucinelli SpA, which is adopting a go-slow approach to the Asian nation. “In a hyper-connected country like China, the risk is becoming something ordinary.”

Several brands are proving more resilient. Hermès reported a 1% increase in third-quarter sales in the region that includes China, although that was below expectations for 2.3% growth. Despite slowing growth in China, Hermès’ performance has managed to hold up as its most loyal customers still splurge on the priciest products, such as jewelry, handbags and ready-to-wear fashions, Hermès CFO Eric du Halgouet told reporters.

Prada posted a 12% increase in sales in Asia Pacific during the same quarter, and a 48% gain in Japan on spending by tourists. The company has been outperforming its rivals thanks to the success of its sister label Miu Miu, which is popular among Gen Z consumers.

Investors are watching to see whether Chinese stimulus will help buoy demand, although there is little evidence of that happening yet. Foot traffic at major malls across China during the weeklong holiday at the start of October was 18% lower than a year earlier, according to Baidu Inc.

Even if the economy improves, shoppers are less likely to assign value to luxury items in the way they did before.

Aspirational Chinese “no longer need brands to define their joy or labels to prove their affluence,” said Jessica Gleeson, CEO of BrighterBeauty, a Shanghai-based retail sector consultancy firm. “Investments in self, health and entertainment experiences are where dollars are moving and I don’t see the trend reversing.”

Zhang Tong used to spend at least CHY100,000 ($14,000) a year buying Gucci bags, limited-edition Air Jordan sneakers and fancy dresses as she sought to emulate the well-trodden path of China’s successful as a grade A student.

“I didn’t have much of my own thinking and judgment back then,” said Zhang, 24, who lives in Shanghai. “I just knew there was a standard way to follow, to wear or act like a cool person, so I was just following.”

Now she’s pursuing a PhD program in museology, and her preferred outfit is a plain T-shirt, a free canvas bag from her university and a pair of Crocs. Being cool no longer means showing off the biggest brand names and pursuing a certain career, but having the best story to tell on social media.

“Being expensive is no longer enough,” said BrighterBeauty’s Gleeson. “Chinese consumers have discovered that the ability to buy more does not earn you more happiness or fulfillment.”